Do You Really Need to Get Insurance For Your Diamonds?

From life insurance, car insurance to alien abduction insurance, almost everything under the sun can be covered with a policy. But the million dollar question is, do you need one for your diamond ring too?

Like any other expensive purchase, getting an item insured helps to protect the value of our assets in the event of an unfortunate scenario. And contrary to popular belief that diamonds are indestructible, they are actually susceptible to damage.

In fact, according to the nation’s largest jewelry insurer, Jewelers Mutual, the majority of claims filed last year were comprised of accidental loss and damage.

In this article, we are going to discuss the various aspects of insuring a diamond ring and help you informed decisions when you are making plans for asset protection.

Why Should You Insure Your Diamond?

While the obvious reasons for getting jewelry insurance (such as mysterious disappearances, theft, fires) are usually mentioned in sale pitches, there’s a lesser known reason for insuring a diamond.

Did you know that the process of setting a diamond can pose a significant risk of damage due to chipping? This risk is heightened when the stone has a lower clarity grade like I1 or I2 and has grade making inclusions like feathers.

Here’s an example to illustrate this.

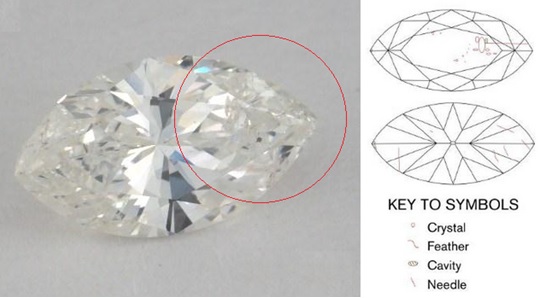

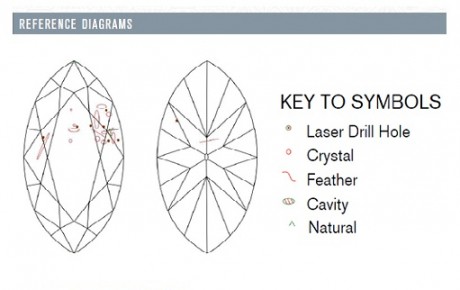

Having huge feathers near structurally weak points can cause issues during setting.

From the plot, the feathers found near the tip of this marquise diamond can seriously weaken its crystalline structure. This makes the marquise a high risk candidate for chipping or cleavage to occur when a downwards force is applied during setting and normal wear.

As a result of the risk involved, it would be a good idea to get the loose diamond insured prior to having it set by a bench jeweler. In the unfortunate event of damage occurring, you can still fall back on making a claim against the insurance company.

Hmm… My Jeweler Has a Lifetime Warranty on My Purchase

If your jeweler already provides a lifetime warranty, do you still need insurance in this case? After all, if you damaged your ring, all you need to do is to send it back for a repair right?

Well, this is a common misconception many consumers have. Warranties and insurance actually refer to completely different things. Also, you need to read the fine print to understand what the jeweler covers in their lifetime warranty clause.

Usually, the warranty only covers workmanship issues for the ring setting. For example, if a prong is bent or if you lose a diamond as a result of improper craftsmanship, they would be liable to offer free repairs or replacements stated under their warranty.

However, if the piece of jewelry is damaged due to your negligence, the warranty is usually voided. Likewise, accidental losses that have nothing to do with workmanship issues are NOT covered under warranties. You need an insurance plan for such scenarios instead.

Basic Terms to Understand When Insuring a Diamond

Appraisals are important for insurance purposes.

Unlike policies for other types of coverage, insurance for jewelry is different in terms of what can be covered and what may not be covered. That’s why you need to read and understand the details of each policy carefully.

For example, a rider clause on a homeowner’s policy may only insure the jewelry against certain types of losses like burglary and thefts. Under a homeowner’s policy, partial damage to a piece of jewelry may not be covered.

Generally speaking, diamond insurance can be generalized into 3 main types: Actual Cash Value, Agreed Value and Replacement Value.

Actual Cash Value insurance takes your diamond’s current market value as the reimbursement value regardless of its initial price of purchase.

Agreed Value insurance is the value of what your diamond is worth as agreed by you and your insurance company at the point of signing the policy.

Finally, with Replacement Value, the insurance company simply pays an amount of money for a “new” item which can be used to replace your jewelry. This means if they can find a good replacement deal, they can pay less than what is stipulated in the policy.

Out of these 3 types, the Replacement Value policy is the most popular option for consumers when it comes to insuring jewelry. But the caveat here is that the insurer’s definition of a “similar” replacement item may be different from that of yours.

For example, they may define GIA triple excellent diamonds as being alike. But the truth is far from that. In fact, there is a broad range of variances within the GIA triple excellent range.

This is why the policy details matter and why you need to be 100% clear about the terms and conditions.

With that, I hope this article has been useful in helping you understand the various forms of insurance in the market. On the next page, I will show you more insights on choosing a suitable policy that suits your needs.

Related Articles

Leave A Comment

4 Comments

Hello, Paul. I have read over your guide to buying diamonds and have a few questions. I recently lost one diamond earring while on a trip. I reported it to my insurer who then let my insurance company (Progressive) know. I received a call from the Progressive representative who encouraged me to have the company that she said Progressive deals with (NeilDiamonds in NJ) in replacements such as mine.

The owner called me and made arrangements for me to send my earring to them (secure and insured). He then called me and let me know that they had found a diamond that almost matched the one lost. I then told him that I have been planning on upgrading my earrings to slightly larger. He told me that he could not help with that because he had not sold me the original diamonds and could not be sure of the value of my diamond. I then told him that if I went ahead and just had him replace the one diamond then I may run into the same problem here with the jeweler who created my earrings – each diamond from a different dealer. He then said he might be able to help me but needed my diamond certification which I sent him. He then said that he could not be sure that certification was accurate because the certification I have is from an EGL not GIA and he only uses GIA.

My current diamonds are 1.58 and 1.59 and I have been sent a check for almost $12,000 from my insurer for the replacement of the 1.59 diamond which was lost but I do not think I want the jeweler in NJ to replace it.

At this time my thoughts are that I should have him return my diamond earring and I should start over here in Pittsburgh. Should I have a GIA certified person recertify the diamond? It all seems so iffy. One thinks they are buying a good diamond but then it is not as clear as all that.

Thanks in advance for any help you might give me.

First of all, I’m sorry to hear about your troubles. At least your insurance company is doing the right thing. And let me tell you that your insurance agent is very generous to have sent you a $12,000 cheque for that lost diamond. Even if the one you lost was a D/IF EGL diamond, I can tell you that it is worth far less than that in value.

Also, Neil Diamonds is right about the EGL grading and the fact that they only sell GIA diamonds is a step in the right direction. EGL is a scumbag of a grading lab. The back story is that they got sued for misrepresentation and subsequently closed down business.

I think recertifying the diamond with a GIA lab is a good choice as this will allow you to know exactly what you have on hand. After that, finding a matching diamond would be much easier once you have the details.

To help you find a matching diamond to replace your lost stone, you can refer to this url here: https://beyond4cs.com/earrings/choosing-the-best-diamond-studs/

This article here will give you some ideas on what you can get for $12000: https://beyond4cs.com/jewelry-guide/12000-diamond-engagement-ring/

Hi Paul – Hope all is well. My boyfriend and I are looking into engagement rings and are working with a jeweler in our area. There are 2 diamonds we are considering, both are good quality based on the 4 C’s and just under 1.5 carats. One diamond is GIA certified and the other diamond isn’t, and there is a $3K difference in price for that reason. What is the downside of going with the diamond that isn’t GIA certified when insuring the diamond? Thanks!

Well, the biggest problem is you don’t know what you are getting. In fact, I can tell you without a shadow of a doubt that you will end up overpaying significantly for the diamond. For insurance, you want to be paying the right premium for the right quality of the diamond. If you don’t know the quality of the diamond, how do you determine the value of the diamond?