Where Do Diamonds Come From And Where They Are Found?

Every year, more than 130 million carats of natural diamonds are mined, processed and sold globally. It is estimated that 30% of these rough diamonds are used in the jewelry market while the remainder 70% of them end up in industrial applications.

Given the important role that diamonds play in our everyday lives, have you ever wondered where do diamonds come from or where they are found? If you did, you’ve come to the right place.

In this article, we will reveal some fascinating statistics about the diamond producing countries, the huge conglomerates involved and interesting information about the places where diamonds are found.

Let’s jump right in…

Here is a list of topics we will be covering:

- What Countries Do Diamonds Come From – Statistics?

- Where Are the Best Sources For Gem Grade Diamonds?

- Which Countries Cut And Polish the Most Diamonds?

- Lab Diamonds – Who Are the Largest Producers?

- Where Are the Biggest Diamond Mines in the World?

- Who Are the Top Diamond Mining Companies Globally?

- Does the Source And Origin of a Diamond Matter?

- Wrapping Things Up – Facts, Numbers And Stats

What Countries Do Diamonds Come From?

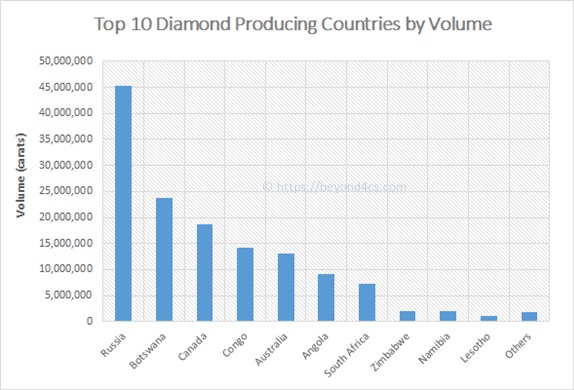

Globally, diamonds can be found in more than 30 countries around the world. However, the vast majority of diamond production is concentrated within 5 countries, namely: Russia (45 million carats), Botswana (24 million carats), Canada (19 million carats), Democratic Republic of Congo (14 million carats) and Australia (13 million carats).

Collectively, these 5 countries account for more than 80% of the world’s supply of rough diamonds and below, I’ve also provided a brief overview of diamond mining in these countries.

Russia – It is widely believed that Russia holds the world’s largest reserve of rough diamonds and this is largely concentrated in the Yakutia region of northeastern Siberia. ALROSA is the state-owned mining company that has a near-monopoly of the industry in the country and they operate more than 10 mines in the region.

Botswana – Botswana may be a small African country but it is the 2nd largest diamond producer in the world behind Russia. The country’s massive volume of rough diamonds is driven by two of its primary mines – Orapa and Jwaneng. De Beers has a 50/50 partnership program with the Botswana government to run and operate these mines while the smaller mines are operated by companies like Lucara and Gem Diamonds.

Canada – Canadian diamonds have gained a reputation for being “clean” and conflict free because of strict environmental regulations and worker interests. Ekati is the first operational mine that was discovered in 1991 followed by the opening of Diavik mine several years later. While the kimberlite pipes in Canada are highly productive, they are also located in the far reaches of the Arctic region. This makes mining operations very difficult under extreme and frigid environmental conditions.

Democratic Republic of Congo – While the DRC is Africa’s largest diamond producer, the political environment has always been plagued by turmoil and tension. Unlike other high volume producing countries, the mining sector is made up of largely artisanal miners instead of big commercial players. DRC has also been known for producing “conflict diamonds” where mining operations are controlled by rebels and there is little care for labor or human rights.

Australia – Currently in fifth place for production volume, Australia’s Argyle mine is renowned for the fancy colored gemstones it produces. This mine is operated by Rio Tinto and produces largely industrial grade diamonds. It is important to note that the Argyle mine is near the end of its life span and the deposits there have been depleted.

Where Are the Best Sources For Gem Grade Diamonds?

In nature, diamond formation is a violent and chaotic process that happens deep within the Earth. As you can imagine, rough diamonds that are created naturally aren’t going to be perfect and will usually have some degree of flaws.

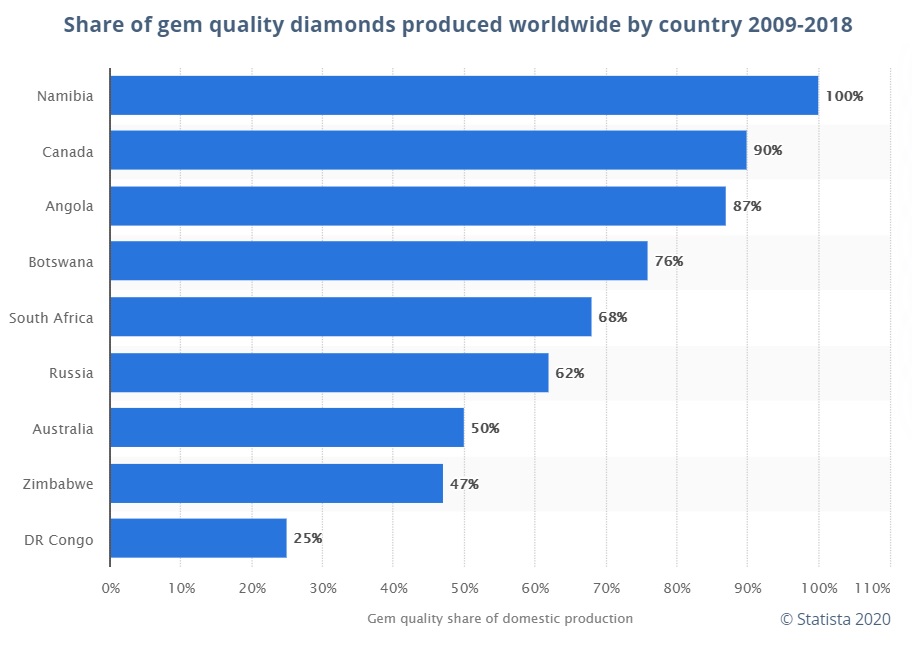

Depending on the source, the quality of mined diamonds can range from being industrial grade to being suitable for usage in jewelry (gem-grade quality). Below is a chart that depicts the share of gem and near-gem quality diamonds for the major diamond producers from 2009 to 2018.

It is estimated that 90% of diamonds from Canada will be of gem or near-gem quality while only 62% of Russian diamonds will be classified in the same category. While Russia is the world’s biggest producer of diamonds, its production numbers include a large portion of industrial grade diamonds. This results in a lower price per carat value of their overall diamond production.

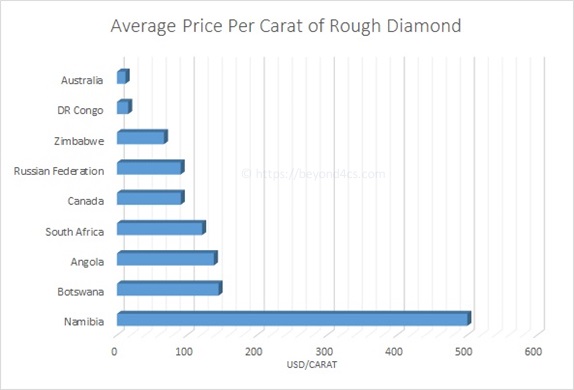

From the chart above, it is very clear that Namibia’s rough diamonds fetch the highest price per carat in the world by a wide margin. The reason behind this is that most of Namibia’s diamonds are mined off-shore as secondary deposits which are washed into the rivers and oceans.

During this process, the rough diamonds have to undergo severe weathering and withstand the elements of nature. As a result, only the higher quality diamonds find their way into the secondary deposits while the heavily included diamonds don’t survive the journey.

This is why the diamonds produced by Namibia are of exceptional quality and command a high average value per carat.

Which Countries Cut And Polish the Most Diamonds?

In their raw form, rough diamonds look unassuming and do not display the beautiful sparkle that most people associate them with. Hours of planning, faceting and polishing are required by skilled craftsmen to produce a gemstone that radiates brilliance in the light.

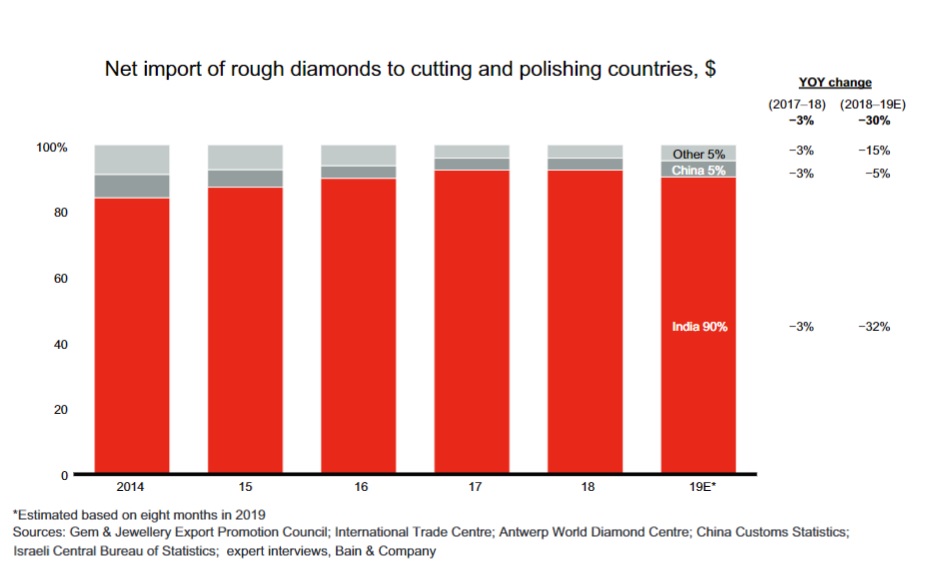

India dominates the cutting and polishing industry with a market share of nearly 90% because of its low labor costs and a favorable regulatory environment. Outside India, China is the next largest polished diamond manufacturer due to its strong domestic demand for jewelry.

The “Others” segment is mainly made up of smaller niche market players found in New York City and Israel that deal with specialty stones like large-sized diamonds or highly valuable fancy colored diamonds.

Lab Diamonds – Who Are the Largest Producers?

Lab created diamonds have been disrupting the jewelry industry and they provide a less-expensive alternative to consumers shopping for an engagement ring. Besides cheaper prices, lab diamonds are also conflict-free and eco-friendly compared to mined diamonds.

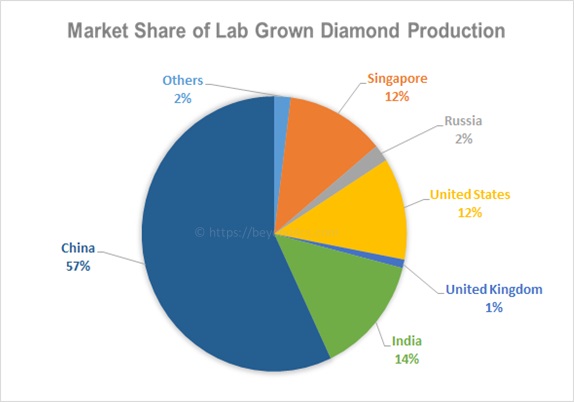

The global market volume of synthetic diamond production is estimated to be around 6.5 million carats and it is growing at a rapid clip annually. Here’s a rough breakdown of the biggest producers of lab diamonds in the world.

Currently, most of the synthetic diamonds are produced in China and exported to consumers in the western world. China holds more than 50% of the market share and uses HPHT (high pressure high temperature) technologies to produce their diamonds while countries like USA and India adopt CVD (chemical vapor deposition) techniques to make their diamonds.

Where Are the Biggest Diamond Mines in the World?

The world’s diamond deposits are largely found in Africa, Russia, Australia and Canada. Here are the top 5 biggest diamond mines in the world where large deposits are found and being mined.

#1 Aikhal – The Aikhal mine is located in the Yakutia region of Russia and is one of the most productive diamond mines in the world in terms of volume. It was originally an open-pit mine but was later converted into an underground mine to extend its lifespan to 2021. Its reserves are currently estimated to be a whopping 176 million carats.

#2 Jwaneng – The name Jwaneng has a literal meaning of “a place of small stones” when translated in Setswana. But don’t be fooled by its name as this is the world’s richest diamond mine in value. Operated by the Debswana Diamond company, it is the flagship Botswana mine under their portfolio and contributes a massive 60% of their total revenue. It is estimated to have a diamond reserve of about 166 million carats.

#3 Udachny – Established in 1971, the Udachny mine in Russia’s Yakutia region ranks as the 3rd largest mine globally. The word Udachny means “lucky” in Russian and it is blessed with a large underground reserve of diamonds. The latest estimates are placed at 164 million carats. Like many other open pit mines, it was converted into an underground mine to extend its productive lifespan.

#4 Nyurba – Owned by Alrosa, this Russian mine is made up of a total of 3 deposits which are called the Nyurbinskaya Pipe, Botuobinskaya Pipe and Maiskoye Kimberlite Body. Together, they are projected to have approximately 133 million carats in their reserves.

#5 Orapa – With roughly 130 million carats of diamonds in their reserves, the Orapa mine is a joint venture between De Beers and the local Botswana government. Orapa is the biggest diamond mine in the world by physical size and covers a surface area of 1.18 square kilometers.

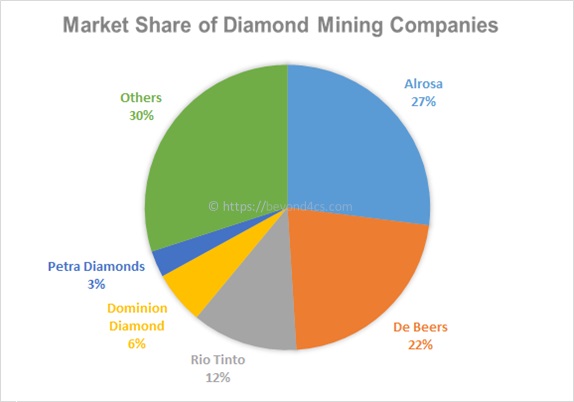

Who Are the Top Diamond Mining Companies Globally?

In the past, the world’s diamond supply is notoriously controlled by cartels such as De Beers but that monopoly has since been broken with the discovery of new diamond sources around the world. Today, the diamond market is supplied by numerous mining companies that vary in the type, volume and value of rough diamonds they produce.

De Beers Group – De Beers is probably the most well known (or infamous) name in the industry and has been around for more than a century. They are involved in many facets of the diamond industry all the way from downstream direct retailing to upstream diamond mining and trading. In recent years, they had also entered the lab-created diamond market with their “Lightbox” brand of synthetic diamonds.

Alrosa – The state owned Russian mining company is the world’s largest diamond producer and also has operations in Africa. ALROSA is also known to discover some of the rarest and biggest fancy colored diamonds in the world (with the most recent being a 236ct amber colored diamond). Alrosa is also a social investment leader among gold and mining companies and contributes to various social and conservation causes in Siberia.

Rio Tinto – Rio Tinto is a publicly listed company that has businesses in global mining and processing mineral resources. They operate diamond mines across different continents like Canada, Zimbabwe and Australia. With strong corporate governance, their goal is to develop sustainable mining operations while providing economic benefits to the countries they operate in.

Dominion Diamond – Dominion Diamond Mines is a Canadian company with major stakes in the Ekati and Diavik mine. They were also the former owners of Harry Winston Inc where they operate a retail arm to sell diamond jewelry but have since sold the asset to the Swatch Group.

Petra Diamonds – A London-based company with a rich history and a widely diversified portfolio of mines in South Africa and Tanzania. Petra Diamonds shifted its core business from mineral exploration to production and grew to become one of the largest producers. Its fortunes turned when business was severely hit by COVID 19 and had to undergo a massive restructuring.

Others – This segment is made up of smaller diamond companies that are usually jointly owned by private businesses and countries. Notably, some of the top diamond producers in this category are Lucara Diamond Corp and Gem Diamonds which have mines in Bostwana and Lesotho.

Does the Source And Origin of a Diamond Matter?

The answer is both yes and no. Ever since the launch of the movie Blood Diamonds, there had always been questions about ethics and controversy surrounding the diamond industry. There’s also increasing consumer awareness about buying products that are associated with conscientious social or environmental values.

Given the growing market opportunity of a better-educated consumer market, companies like Brilliant Earth have also positioned their business to offer products that are sourced from ethical origins and fair-trade policies. Even gemological labs like GIA have started offering grading reports (GIA Diamond Origin Report) that evaluate a diamond’s geographic origin because of the demand for sustainability and ethically sourced products.

In my opinion, it shouldn’t matter whether a diamond comes from a large or small mine or whether it is lab created or natural. However, what does matter is that wherever the diamonds are from, they should be ethically sourced from sustainable practices and the human rights of all stakeholders are protected.

Wrapping Things Up – Facts, Numbers And Stats

I hope this article has given you a better understanding of the upstream diamond industry and a better appreciation of where the shiny diamond on your engagement ring comes from.

If you are looking for more fascinating facts and statistics, head over to these links to learn more about the industry or how diamonds are created. And if you have any questions or feedback, feel free to leave a comment below or get in touch directly via email.

Related Articles

Leave A Comment

14 Comments

Where do the best diamonds come from? I’ve read that Africa produces superb quality diamonds compared to other parts of the world and Canadian diamonds are also of exceptional quality. Should I be looking for a diamond of a specific origin when I buy an engagement ring?

The term “best” is really subjective. It’s true that African countries are major producers of gem grade diamonds and Canadia sourced diamonds are also typically of higher quality compared to sources like Russia or Australia. But if we were to change the criteria a little and say for example, where do the best diamonds that are pink in color from? Well, that answer is Australia’s Argyle mine. It depends on what you are looking for. As a consumer, I think tagging the term “best diamonds” to a particular country does more harm than good. D color IF diamonds that are in the highest tier of the GIA white diamond scale can be produced from many countries. At the end of the day, if you buy a GIA certified stone, then you can be assured of quality.

Can you help me make sense of the chart on gem grade diamonds where you show that Canada has a 90% volume of gem grade diamonds but yet the value of their rough diamonds is only $91.07? On the contrary, Russia has much lower percentages of gem grade stones but still command a similar price per carat value.

To keep things simple, you need to understand that the price per carat value is calculated based on an average across every rough diamond that is mined. For example, if we have 3 rough diamonds that cost $10, $300 and $590, it adds up to a total of $900. The average price of these diamonds would be $300.

Next, the definition or gem grade and near-gem grade diamond is very broad. For example, a D color IF diamond is classified as a gem grade diamond and a much cheaper K color SI2 diamond is also classified as a gem grade diamond. When we take an average of the prices for these 2 diamonds, it doesn’t mean that you will be able to buy a D/IF diamond at the averaged price.

The same reasoning applies when we are looking across millions of carats of rough diamonds. The lower end gem grade diamonds will pull down the average value while the higher end gem grade stones will inflate average prices. I hope this made sense. If it doesn’t, let me know again and I’ll try explaining using mathematical examples.

Do you have statistics on the breakdown of lab created diamonds produced by CVD or HPHT? What countries do diamonds come from that are created by each process? Is one method preferred over the other or does it depends on the country’s and available resources in that region?

I don’t have the specific stats that you are looking for but I estimate it to be close to 60/40. Both processes are relatively fast in terms of manufacturing but currently, there are some scientific gaps and technological know-hows to growing large carat sized diamonds by CVD. China is the country that mainly use HPHT to create diamonds while most western worlds use HPHT for commercial-scale lab cultured diamonds.

For gem grade diamonds, I would say that CVD is a better process to produce diamonds because of lesser inclusions and better colors. HPHT is a more understood process and generally produces tinted colors of lower value. I say this very broadly and there is some active research into both types of processes to improve yields and specifications. I suspect we could be seeing breakthroughs in the coming years.

Where do most diamonds come from that are pink and red in color? I’ve read that Australia and Brazil are good sources. You’ve mentioned that Russia also produces fancy color diamonds in the example above.

Most of the pink and red diamonds that are higher in quality tend to come from the Argyle mine. I don’t have the exact statistics or numbers as to how many percent of Russia’s diamonds are in the highly desired rare fancy colored category. But as an estimate, it would be much less than 0.1%.

Thank you for writing this article on where are diamonds found in the world. I am collating information for a school project and doing research for a geography project. Can I use some of your data for my report? Also, if you could help me with this other question I have about where diamonds are found in and how scientists actually map out an area to prospect for a mining operation?

Diamonds are found in kimberlite pipes as their primary source. It has to be specific to kimberlite ore because the diamond formation process is very much dependent on the correct temperature and pressure deep in the Earth. If the conditions aren’t right, diamonds cannot form and discovering kimberlite ore is like a “telltale” sign of possible diamond deposits. This link from GIA has some technical information that should help you: https://www.gia.edu/gems-gemology/wn13-advances-diamond-geology-shirey

With reference to the chart about world diamond production by country, when is the time period in which it is valid for and when was this data compiled?

The statistics and figures are compiled and up to date to 2019.

Hi Paul,

I have a question regarding the country of origin for GIA graded diamonds. I’ve come across a report that says “Mixed” next to the country of origin. I’ve tried to find Out what this means on the web but haven’t had much luck. Could you share some light on what a “mixed” country of origin is and whether this is good, bad or neither?

Thank you!

From my understanding, it is neither good nor bad. It’s just an objective assessment that GIA provides based on the diamond’s morphology and spectroscopy results. However, you do have to note that the country of origin of the rough diamonds is submitted by the person/company. The accuracy of the country of origin is only as good as the mining company documentation supplied.

And when GIA performs a follow up examination of the polished diamonds, they will state the country of origin if they are sure of it based on the lab tests they perform. Sometimes, GIA cannot make a definitive conclusion on the origin and they will state so in the grading report.

This is something new to me as well and I don’t profess to fully know the entire process flow for grading the diamond’s country of origin. You should check with the seller of the stone to find out what exactly is the meaning of “mixed”.