What is the Rapaport Diamond Report & How Useful Is It?

Whenever the topic of diamond pricing is brought up, the name Martin Rapaport is immediately going to ring a bell. He is one of the world’s most renowned diamondtaire and is responsible for the industry price list that jewelers around the world follow, the Rapaport Diamond Report.

What Made the Report Necessary And How Was it Born?

The Rap report is a weekly diamond price list that professionals use.

Martin Rapaport was born and raised in an intellectual family. He started his career as an apprentice diamond cleaver and worked his way up in the industry. His career path took a change after he created RapNet – The Rapaport Network.

But what led to the wide-spread acceptance of the Rap report instead of any other diamond price lists created by other organizations? Well, there’s quite an interesting history which I would briefly get into.

Diamonds have become rather ubiquitous nowadays and they have become equal members of our globalized democracy. Today, diamonds are accessible to anyone who can afford them.

However, it wasn’t always like this in the past. Back then, your access to certain goods was strongly related to your social status. Even if you had the money, you couldn’t buy diamonds unless you came from an upper “social class” or had certain privileges.

Once the global market started to democratize, the pricing strategies which were initially relevant only to insiders soon became deprecated and chaos ensued in the market. In the 1970s, price manipulation and speculation in the market was rife.

Diamond prices experienced wild fluctuations and an industry standard price guide was urgently needed to stabilize the market. By funding the Rapaport Group in 1976 and creating the world’s first electronic diamond trading network, Martin Rapaport managed to standardize the pricing schemes for diamonds through the publication of the Rapaport Diamond Report.

Since then, the Rapaport Group has become the most reliable source of diamond price listings and even grown to be one of the largest trading networks.

The Significance of Martin Rapaport in the Diamond Market

The Rapaport Report proposes certain target prices for different sizes, qualities and shapes of diamonds. Thus, it connects the main characteristics of the “four C’s” with an additional “fifth C”, which is cost.

Like any other resources, the prices of diamonds can fluctuate from time to time in the world market. By delivering weekly reports on the changes in market movement, the business community can stay in touch and be updated on the latest prices instantly.

Today, Martin is considered one of the most authoritative people in the diamond industry. He influences the global market and is the reason why diamonds with similar attributes cost the same in, say, Korea and the United States.

Access to the price sheet is via paid subscription only. At the point of writing this article, the subscription fees for a monthly report is $180/year and it costs $250/year for a weekly report to be delivered via email.

So, that’s briefly the background behind the Rapaport Report. Now that we had talked about the origins behind the price list, I’m sure the following question would be on your mind: “How useful is it for me?”. As a consumer, how can you utilize the Rapaport report?

Is the Rapaport Report Going to be Relevant to You?

Let me guess. The reason you are reading this article is that you’ve heard a jewelry salesperson quoting the Rapaport report in a sales pitch. You are probably doing your research on the usefulness of the Rap report and don’t want to overpay for your diamond purchase.

Before we delve deeper, there are 2 things you need to be aware of…

First of all, the Rapaport report or RAP sheet is a theoretical system of estimating diamond prices in business transactions. The prices shown on the RAP sheet are intended for use as a guideline only.

Even the Rapaport sheet has a prominent disclaimer noted at the footer of the price list and I quote: “Prices in this report reflect our opinion of HIGH CASH NEW YORK ASKING PRICES. These prices may be substantially higher than actual transaction prices. No guarantees are made and no liabilities are assumed as to the accuracy of the information in this report.”

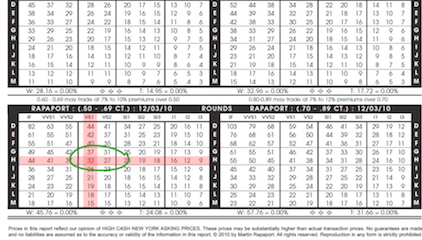

Identifying the price-per-carat for an H color VS1 clarity 0.60 carat round cut.

Secondly, the primary usage of the Rapaport report is for jewelers and professionals to gauge and price their inventory. In a retail setting, it isn’t common for the Rap sheet to be shown to the consumer.

But when a salesperson does use it in a marketing pitch, you can almost be sure that they are trying to overcharge you by using the Rap report as a justification for the prices they are asking for.

How Do I Read the Rapaport Diamond Report?

Did You Know There Are 3 Main Types of Price Charts?

Rapaport publishes charts for the following shapes: Rounds, Marquises And Pears. The price charts for round and marquise cut diamonds are to be used as standalones. On the other hand, the price chart for the pear cut is used as a pricing basis for all other types of fancy shapes.

Demand and supply will be huge deciding factors to determine whether the asking price would be below or above the “Rap price”. Depending on other factors such as the diamond’s make, a seller may trade the diamond at a price that is 30% off Rap prices or even charge a premium of 5% on top of the Rap price.

The Pricing Mechanism of Diamonds Is More Complex Than Rap Reports

Learning to calculate the price of a diamond using the Rap report isn’t difficult. What most consumers fail to understand is that the listed prices on the Rap sheet aren’t sufficient for the layman to correctly price a diamond.

As mentioned earlier, the figures you see in the price list are calculated based on a high asking price and reflects prices for well-cut and properly finished qualities. Diamonds that detract from ideally cut proportions or have significant issues in their finish generally trade at huge discounts to the Rapaport asking prices.

What About Fluorescence?

If you are observant, you probably noticed that there isn’t any columns or rows stipulated for diamonds with fluorescence in the Rapaport report. This is another “hidden factor” that isn’t made explicit. Generally speaking, diamonds with strong or very strong fluorescence get discounted with a 10-15% rate.

On top of that, it is almost impossible for a consumer to determine whether a diamond was placed on a memo and brought in specifically for a prospective purchase. The stuff that goes on behind the scenes go even further and I’m just going to list a couple of examples why the Rap price might not be necessarily accurate.

For example, if the store made bulk purchases from a particular supplier, they would enjoy significantly lower prices. On the other hand, if the store took out a massive loan from the bank to bring in the diamonds, you can expect the costs to be factored into the end prices.

While it is common for diamonds to be traded at discounts within most categories shown in the price list, dealers and wholesalers in the industry follow their own “set of rules” for certain categories of diamonds. For example, round super ideal cut diamonds with D color and Flawless clarity would almost certainly sell at premiums with 10-20% more than the stated price-per-carat value.

Without experience in the industry, these are subtle, yet important details that a general consumer would not know about.

Where Should the Consumer Get Informed About Diamond Prices?

Do you really need access to the Rapaport report?

As a consumer, paying for a subscription to the Rapaport Report doesn’t make economic sense if you are only making a one-off purchase for an engagement ring. And as I said earlier, the Rap report has limited uses for a consumer.

Even if you wanted to use it as a reference (despite knowing how useless it is for diamond ring shoppers), it would be better to make a request with the jeweler you are working with and get them to show you the Rap sheet. Chances are, they are probably subscribed to the Rap report and would be willing to show you some details.

Buyer Beware!

I had built up vast experiences of visiting jewelry stores and frequently encounter salespeople who use misleading tactics. The most crafty pitch I came across happened when the jeweler whipped out the Rapaport report and showed me the price-per-carat value of the ring I was looking at.

He continued: “The wholesale price for this diamond is $15,400 and our prices only reflect a mere 10% markup at $17,000.” To the layman, it might sound like a great deal. But you know what? The cut of the diamond was only graded as Very Good and it was way overpriced.

If something similar happens to you in the store, leave and take your business elsewhere. These jewelers are basically preying on uneducated consumers and sadly, many people do fall for such tricks.

When it comes to diamonds, you shouldn’t expect offers like “20% off this Friday” – leave that to blue suede shoes and teddy bears. Bear in mind that it is normal for distributors to offer different prices because of different business costs and markups. However, if you come across deals where the prices are “too low” or too good to be true, you better be wary. Chances are, there’s a catch somewhere.

If you are on a tight budget and this is the reason why you are so interested in pricing, you might want to check out a list of online jewelry distributors I highly recommend.

Not only can you get higher quality diamonds, you will also get to enjoy better prices as they do not have huge overhead expenses like showroom rental fees.

Related Articles

Leave A Comment

8 Comments

I found your website (How to Avoid the Shopper’s Trap) very informative. Unfortunately, I came across your page too late. I went to the Diamond District yesterday with my girlfriend/fiancé, and while we thought we were prepared, it turns out we were not. Can you offer any advice on how to help us out?

We went to a store in the corner of 47th and 6th, got a hard sell, but eventually pulled ourselves from the grasps of the salesman and told him we wanted to look around. At that first store, they told us that all they sell is GIA certified. When we were making our way out, a guy told us to come to the other side because it was a different store. That store is Fantasy Diamonds. (Turns out the first store gets a commission for the “referral”.)

We sat down and Dave came over and was very nice and showed us a number of settings and then diamonds. Showing as a Rapaport report, he recommended us a clarity enhanced diamond and told us that it’s a nice way to get something a little bigger that looks just as good as a non-enhanced diamond. This diamond was way cheaper than anything we compared to on the Rap sheet. We didn’t realize it at the time, but the diamonds he was showing us were GAI certified (not GIA). He never mentioned any difference, and we didn’t catch the difference either. We liked a setting and a diamond that he showed, but we were not sold on the price–it was a E vS2 1.87 carat, princess cut (but more rectangular). The first “best” offer was $12,500 or so, but then after we were pressing that we would like to look around, they continued to lower the price down to $9,000. At that point the store was closed (we were 30 mins past closing), and we still said we need more time, and then they guy said he would do an end of the day deal and give it to us for $7,500. Thinking we were getting a great deal, we took it.

Once we got home and looked at it, we realized that the diamond was not GIA certified, but was GAI certified. Then we started looking on line and found your article (and now we feel real dumb, even though we thought we had studied up on everything, but we didn’t know about the traps out there). We went back today before getting the diamond set and asked for a refund. Obviously, they said no and that they don’t do refunds or exchanges. But that guy, Rodi, eventually said he would let us have a GIA certified diamond in exchange (but it was F SI2 and 1.02 carat)–he tried to tell is $11,000 for it, to which we said no. Finally he said he would do it for an even swap, for $7,500. But we believe that is even still too much for that diamond, even though it is GIA certified.

So we again asked for our money back, and he said either it’s the GIA swap or we leave. Feeling defeated, we left, but we’re not willing to let this go without a fight. Is there anything we can do? I paid with visa (Bank of America), but I’m not sure that anything will come from my disputing the charge, because I clearly made the purchase, it’s just that we were duped when we bought it. I am thinking of filing complaints with BBB and the Consumer Protection (whatever it is), and also write negative reviews on all review sites. I am also considering filing a lawsuit.

I’m sure you are very busy and get a lot of emails, but I’m wondering if you can give me any thoughts or advice. We clearly got scammed, and I wish I saw your article before we went shopping, but we are where we are now and are looking for ways to move forward and get this resolved. This is supposed to be something very special and exciting, but now we’re both distraught over this and upset. Can you offer your thoughts/advice?

The best course of action is to call your bank now. You were clearly ripped off with a misrepresented sale. If that doesn’t work, you have the right to file a complaint if you have a dispute with a jeweler. Call the Consumer Affairs Hotline at 311.

Thanks for the quick response, Paul. I called my credit card company earlier this afternoon and they could not cancel the transaction because it was pending. They told me to get back in touch when the payment posts. Is there a best way to present this when disputing the charge? The guy at the store laughed when I told him I would dispute it and acted like I won’t be successful.

Separately, is it a good idea to take the diamond to an independent appraiser in the meantime, or is that a waste of money at this point?

It really irks me to see someone behaving in this manner. The fact that they laughed at you when you tell them about your problem and are not taking proactive steps to address your purchase says alot about these scumbags.

Taking the diamond to an appraiser is just a waste of money and time. It doesn’t change the fact that you have a bad purchase on your hands. DO it the hard way with the complaint office and CC company if you need to get your money back. And then get started all over again. This time; never at the NYC district.

Where can I download free rapaport price lists? If you can tell me where to get them, I can run my business and source for wholesale diamonds. It is greatly appreciated.

As I said in the article, the diamond rap sheet is only available for a PAID fee or subscription. Seriously, if you are running a wholesale business and you are asking a question like this, I think you would do yourself a favor by leaving the business now. One, you have totally no clue what you are doing and you will lose your shirt in this industry. Two, if you do know what you are doing, you would already know that the Rap sheet requires a payment and you asking where to download it like a pirate really reflects badly on your integrity.

Let me start by thanking you for making such an informative site, I learned a lot about the daunting task of buying an engagement ring from it. I do have a question about the mark up on a veraggio ring that I hope you can help me with.

Background:

A little about myself, I’m planning to propose to my GF within the next few months. Between rent, loans and life I saved up some money and I have a budget of $10K for the entire engagement ring. I already purchased a lovely 1.3 carat 7 millimeter round diamond for $7.6K. And now, after many hours of searching for a setting I finally found a verragio that I really like.

The Ring:

It’s a customized version of the simpler Parisian 120 https://www.verragio.com/make-it-yours.php?prod_id=997

(Customized to be white gold with rose gold wraps and lace).

The base price online is $1400

Issue:

The jeweler i’ve been talking to (Diamonds Direct) told me that they could do it and would even waive the customization fee (which I found out from a separate jeweler was a standard fee of 400 dollars extra) and setting fee. HOWEVER they are now quoting me a price of $2200 for the 14k version with the aforementioned customization.

Question:

That’s over a 50% mark up! Am I being ripped off? What is the typical mark up from the online wholesale price that I should expect on a ring like that?

I’m about to pour about a year’s worth of rent money into a small shiny piece of jewelry. I am willing to pay it but I don’t want to be taken advantage of. I would be grateful for any insights. Thanks!

For branded settings like the Verragio designs, you cannot get it “wholesale”. It doesn’t exist for everyday customers or even to me if I were to shop. Most branded designers only sell through authorized retailers.

Different vendors have different overheads and bench jewelry costs. In your case, for customization work, I really cannot speak for costs as I am not sure the scope of work involved. You may want to get a separate quotation from White Flash:

https://www.whiteflash.com/engagement-rings/solitaire/verragio-split-claw-4-prong-solitaire-engagement-ring-2205.htm

They are a trusted vendor I recommend and offer competitive pricing. Let me know if they can quote you at a better price.